refinance transfer taxes new york

Unfortunately for those moving from almost any other state in the US New York will seem mighty expensive. File state taxes for free Get Started with Credit Karma Tax 4.

Wordle Has Officially Moved To The New York Times Here S What You Need To Know

Heres an example of how state and local real estate transfer taxes can affect the ultimate cost of buying a house.

. Julie has been quoted in The New York Times the New York Post Consumer Reports Insurance News Net Magazine and many other publications. Local Economic Factors in New York. Your employer will typically withhold only state and local income taxes from your paycheck but you may also owe local taxes and other taxes depending on where you live.

Getting a mortgage in California can be different from shopping for a mortgage in other states. Each state and its taxing body have different rules for how their real estate transfer taxes work. Also called a non-warranty deed a quitclaim deed conveys whatever interest the grantor currently has in the property if any.

Many states that charge these taxes base the tax amount on a percentage of the purchase price of the property. A judge in New York held former President Donald Trump in civil contempt Monday and imposed 10000 per day in fines after the New York Attorney Generals office said Trump defied a subpoena. Julie Garber is an estate planning and taxes expert with over 25 years of experience as a lawyer and trust officer.

Colorado charges a. Additionally if you live in one of the five boroughs youll. Youre buying the least amount of protection of any deed.

For a rate-and-term refinance the equity requirement will vary by lender but youll most likely need to continue paying PMI even after a refinance if your new loan is worth more than 80. She is a vice president at BMO Harris Wealth management and a CFP. The FHFA stopped reporting new data in 2018.

On top of sales tax hovering near 9 New York charges state income taxes that can tally up to an expensive percentage of your paycheck. For one thing prices are high in California which means borrowers will need more money for a down payment and will have higher monthly housing costs than in states with more affordable real. How real estate transfer taxes differ from other taxes.

You may have to deal with different taxes deductions and credits.

Real Estate Transfer Taxes In New York Smartasset

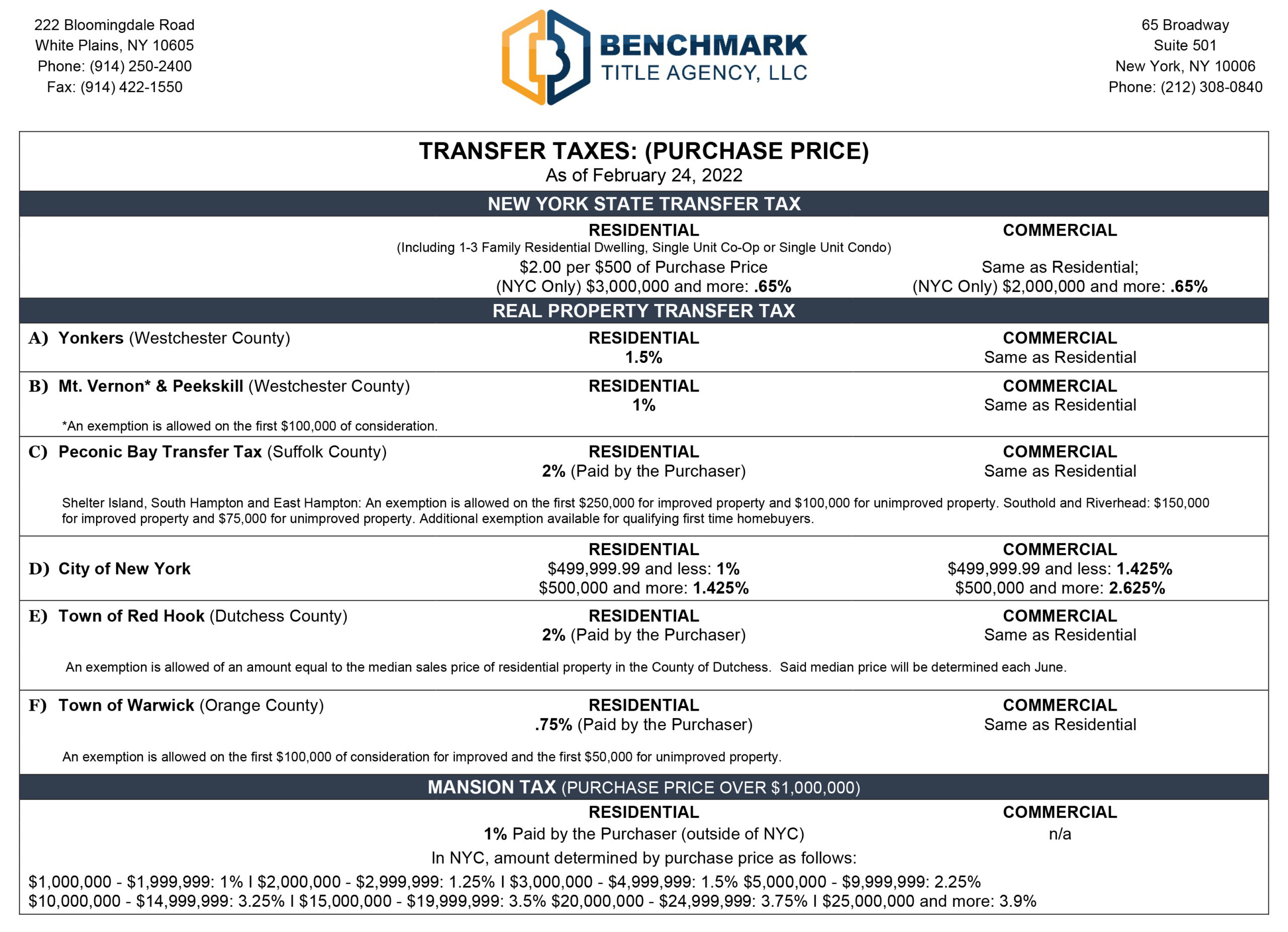

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

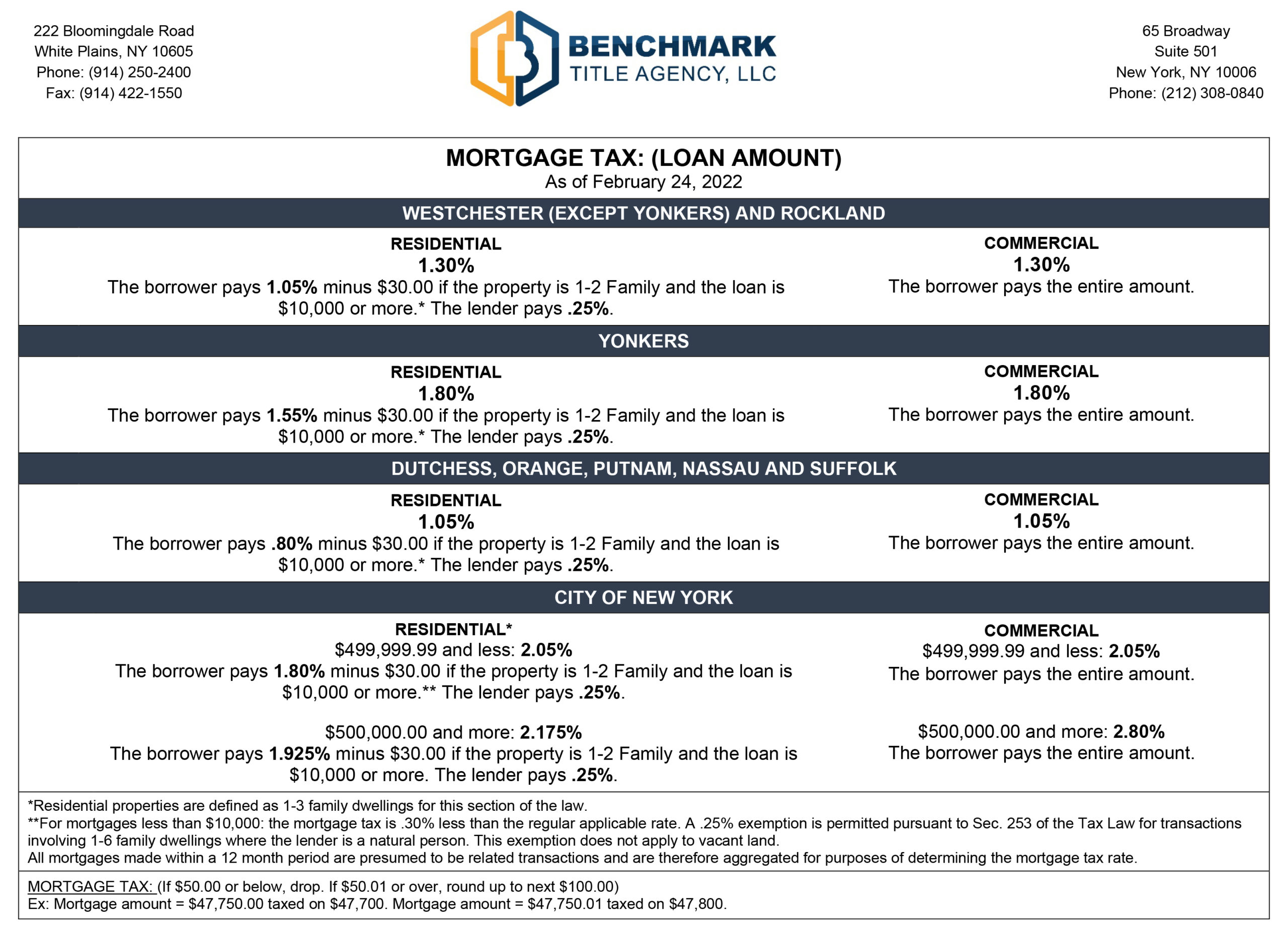

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Brad Lander

Reducing Refinancing Expenses The New York Times

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo

Annual Report On Capital Debt And Obligations Office Of The New York City Comptroller Brad Lander

Saving New York State Mortgage Recording Tax Gonchar Real Estate

How To File A New York State Tax Return Credit Karma Tax

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Nyc Transfer Tax What It Is And Who Pays It Streeteasy

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Transfer Tax What It Is And Who Pays It Streeteasy

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

10 Reasons To Move To Delaware Home Buying Tips Delaware Moving